The EU market can seem like a golden opportunity – with its large consumer base, high internet penetration, and robust economy.

However, if you want to start dropshipping in the EU without understanding the legal landscape can lead to significant risks. So, today, we’ll explore all the complexities and uncover the legal risks of dropshipping in the EU.

Table of Contents

Why dropship in the EU?

Before diving into the legal world, let’s see why the EU is such a promising market for dropshippers. The EU comprises 27 member countries with a combined population of over 447 million people. This offers a vast potential customer base.

Moreover, the EU’s single market allows for the free movement of goods, making it easier to trade across borders within the region.

And according to the latest data from the European Union, 92% of individuals aged 16-74 used the internet in the last 12 months, and 70% of them bought or ordered goods or services online in 2023. Also, 44% of online shoppers bought or ordered Clothes, shoes, and accessories in 2023, according to the same EU report.

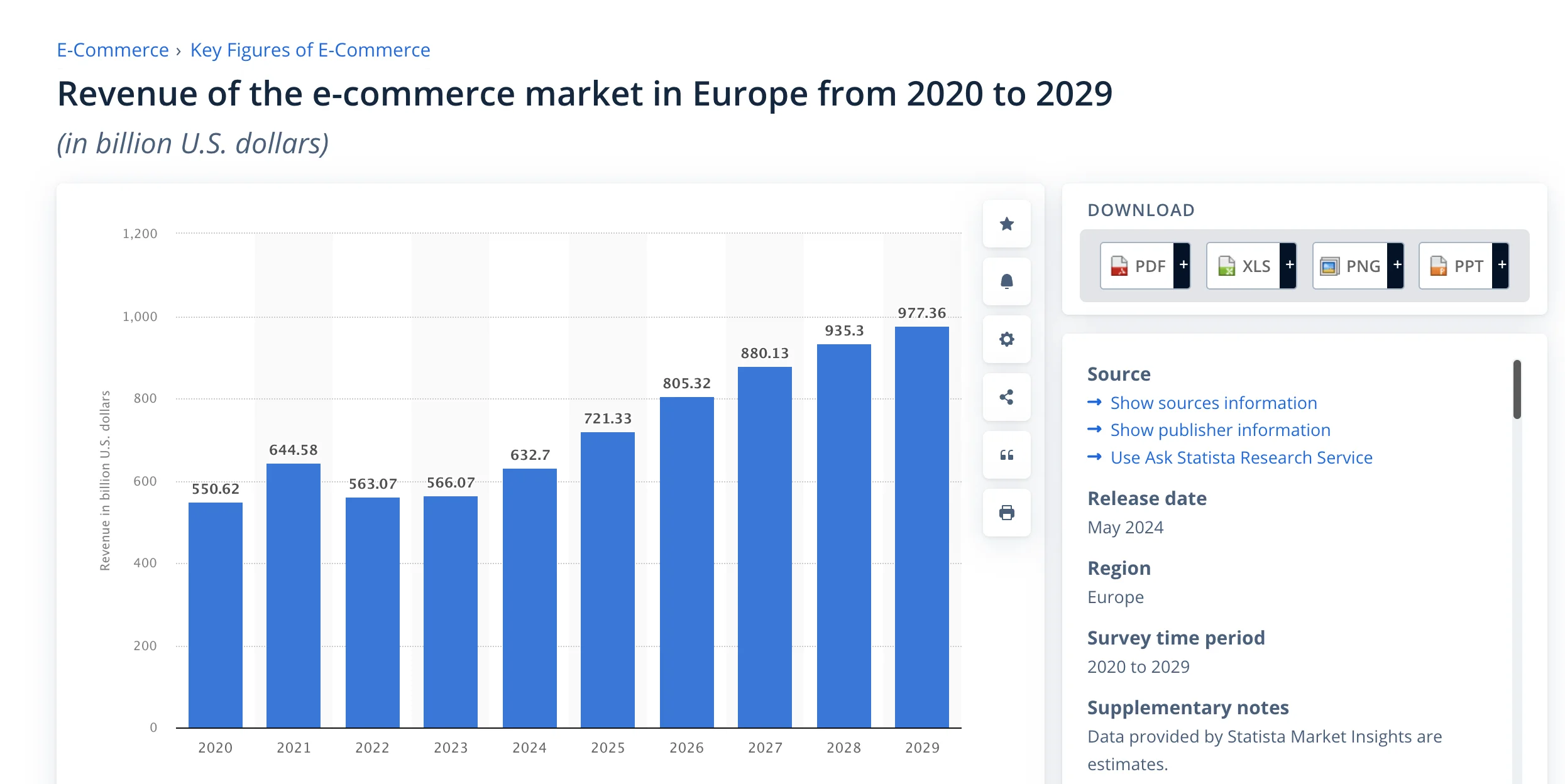

According to a Statista report, revenue in the ecommerce market in Europe is expected to steadily rise between 2024 and 2029, reaching a total of 344.7 billion U.S. dollars, which is a 54.48 percent increase. After seven years of consecutive growth, it is projected to reach 977.36 billion U.S. dollars in 2029.

Navigating the legal landscape of dropshipping in the EU

Compliance with EU consumer rights

The EU has strict consumer protection laws designed to protect buyers. These laws cover a wide range of areas, from product safety to refund policies. As a dropshipper, it’s crucial to understand and comply with these regulations to avoid legal issues.

Consumer Rights Directive

The Consumer Rights Directive (CRD) is a key piece of legislation that you must know about. It provides consumers with certain rights, including:

- Right to information: You must provide clear and detailed information about the product, including the total price, delivery costs, and the right to cancel.

- Right to cancel: Consumers have the right to cancel their order within 14 days of receiving the product without providing a reason. You must offer a full refund, including the cost of standard delivery.

Failing to comply with these regulations can lead to fines and damage to your business reputation. Just like driving without knowing the traffic laws – you’re bound to get into trouble sooner or later.

Data protection regulations

In the digital age, data protection is paramount. The General Data Protection Regulation (GDPR) is a comprehensive data protection law that applies to all businesses operating in the EU, including dropshippers. GDPR aims to protect the privacy and personal data of all EU citizens.

Key GDPR requirements

- Data processing consent: You must obtain explicit consent from customers before collecting or processing their personal data.

- Data breach notification: If a data breach occurs, you must notify the relevant authorities within 72 hours.

- Right to access and erasure: Customers have the right to access their personal data and request its deletion.

Non-compliance with GDPR can result in huge fines, up to €20 million or 4% of your annual global turnover, whichever is higher. Ignoring GDPR is like playing with fire as the consequences can be disastrous.

VAT and tax obligations

Navigating the VAT system in the EU is a crucial aspect of running a successful dropshipping business. Understanding how VAT works and ensuring compliance can help you avoid significant penalties and streamline your operations.

How the VAT System Works in the EU

Value Added Tax (VAT) is a consumption tax applied to goods and services in the EU. It is charged at each stage of production and distribution, with the final burden resting on the end consumer. Here’s a breakdown of how VAT works:

- Manufacturer to Wholesaler: VAT is charged on the price at each stage of the supply chain.

- Wholesaler to Retailer: The wholesaler charges VAT on their selling price.

- Retailer to Consumer: The retailer charges VAT on the final selling price to the consumer.

VAT registration: If your sales exceed a certain threshold, you may need to register for VAT in each EU country where you sell products. The thresholds vary by country, so it’s essential to check the specific requirements.

OSS scheme: The One-Stop-Shop (OSS) scheme simplifies VAT compliance for cross-border sales within the EU. It allows you to report and pay VAT in one member state, reducing administrative burdens. With OSS, you can avoid the need to register for VAT in multiple countries, streamlining the process significantly.

Example Scenario: Selling in Spain with a Supplier from Germany

Let’s say you are based in Spain and your supplier is from Germany. Here’s how the VAT process works:

- Purchase from Supplier (Germany to Spain):

-

- When you buy goods from your German supplier, the transaction is considered an intra-community supply, which is usually zero-rated for VAT. However, you must report this purchase and account for VAT in Spain.

- You will need to self-account for the VAT on this purchase by declaring it in your Spanish VAT return (known as reverse charge mechanism).

- Selling to Customers in Spain:

-

- When you sell these goods to customers in Spain, you must charge Spanish VAT on the final sale price.

- You then remit the collected VAT to the Spanish tax authorities through your VAT return.

VAT on Imports from Outside the EU

If you use a supplier from outside the EU, the process is slightly different:

- Import VAT: When goods enter the EU, they are subject to import VAT. The rate depends on the destination country.

- Customs Duties: Depending on the product, you might also have to pay customs duties.

- Charging VAT to Customers: You must charge VAT to your customers on the final sale price, just like with intra-EU transactions.

Prepaid VAT (IOSS)

To simplify the process for customers, you can opt for the Import One-Stop-Shop (IOSS) scheme. This allows you to collect VAT at the point of sale for goods valued up to €150 imported into the EU, ensuring that customers don’t face unexpected charges upon delivery.

- Example: If you sell a product to a customer in Spain, and the product is shipped from a non-EU country, using the IOSS scheme, you can charge VAT at the point of sale. This way, the customer doesn’t have to pay VAT when the product is delivered, streamlining the process and enhancing customer satisfaction.

Detailed Example: Selling in Spain with a Supplier from Germany

- Buying from a German Supplier:

- Invoice from Supplier: €1000 (zero-rated VAT)

- Reverse Charge Mechanism: You account for the VAT in Spain. If the Spanish VAT rate is 21%, you declare €210 as VAT on your Spanish VAT return but also claim it back, resulting in no net VAT payable at this stage.

- Selling to a Customer in Spain:

- Selling Price: €1500

- Spanish VAT (21%): €315

- Total Price to Customer: €1815

- VAT Remittance: You pay the €315 VAT collected from the customer to the Spanish tax authorities.

This ensures that VAT is properly accounted for at each stage, maintaining compliance with EU tax regulations

Value Added Tax (VAT) is a significant consideration when dropshipping in the EU. The rules are complex, and non-compliance can lead to severe penalties.

Now, we know that navigating these VAT obligations may seem like walking through a maze, but it’s once you get a clear understanding, all will be much clearer.

Intellectual property rights

Respecting intellectual property rights is crucial when selling products in the EU. Selling counterfeit or unauthorized products can lead to legal disputes and damage your brand’s reputation.

Trademark and copyright laws

- Trademarks: Ensure that the products you sell do not infringe on existing trademarks. Unauthorized use of trademarks can lead to legal action.

- Copyright: Avoid selling products that violate copyright laws. This includes pirated media, counterfeit goods, and unauthorized reproductions.

Remember, protecting intellectual property safeguards the value and integrity of your business.

Dealing with returns and refunds

Managing returns

The EU’s consumer protection laws provide customers with strong return rights. So, efficiently managing returns is essential to comply with these laws and maintain customer satisfaction.

Return policies

- Clear return policy: Clearly state your return policy on your website, including the process for returning products and the timeframe for refunds.

- Handling returns: Develop a system to handle returns efficiently, including coordinating with your suppliers to process refunds and replacements.

Handling returns is like managing a delicate balancing act – it requires precision and attention to detail.

Read more: How to create a great dropshipping return policy

Refund procedures

Providing prompt refunds is not only a legal requirement but also a best practice for maintaining customer trust.

- Refund timelines: Process refunds within the legal timeframe, typically 14 days from receiving the returned product.

- Communication: Keep customers informed throughout the refund process, ensuring transparency and trust.

Effective refund procedures will keep your business running smoothly.

Strategies for legal compliance in the EU

Stay informed and updated

EU laws and regulations can change, so it’s crucial to stay informed about any updates that might affect your business. Subscribe to legal newsletters, join ecommerce groups and forums, and consult with legal experts to ensure you remain compliant.

Consult with legal professionals

Working with legal professionals who specialize in ecommerce and EU laws can provide invaluable guidance. They can help you navigate complex regulations, draft compliant policies, and avoid legal pitfalls.

Use compliance tools

Use tools and software designed to help businesses comply with EU regulations. These tools can assist with GDPR compliance, VAT calculations, and monitoring changes in legislation.

Educate your team

Ensure that your team understands the importance of compliance and is trained on relevant regulations. This includes customer service representatives, marketing teams, and anyone involved in handling customer data.

Implement strong policies

Develop and implement robust policies for data protection, returns, refunds, and consumer rights. And clearly communicate these policies to your customers and make sure they are easily accessible on your website.

Conclusion

As we said in the beginning, dropshipping in the EU offers huge opportunities, but it all comes with a complex legal landscape. From consumer protection laws and data privacy regulations to VAT obligations and intellectual property rights, understanding and complying with these regulations is crucial for your dropshipping business’s success.

So, make sure you approach EU dropshipping with a clear understanding of the legal risks and a strategy for compliance. Stay informed, consult with legal professionals, and implement robust policies to protect your business and build customer trust.

Read next: eBay dropshipping: risks and challenges for newcomers