If you are in the process of setting up your online store or thinking about other payment methods or gateways to add to your dropshipping store, then you landed in the right place.

You can also watch our video below on the crucial decisions you need to make when choosing the right payment method for your dropshipping store.

Now, in case you’re more of a reader than a viewer, we will take you through the most common payment methods, what to look for when choosing the right payment gateway for your store, and some of the best 3rd party payment gateways as the preferred (and recommended) way for setting up your dropshipping store throughout this next article. Here we go.

Table of Contents

What are the most common payment methods?

The competition in the ecommerce world has never been higher, and one way to stay ahead of other online stores is to add the preferred payment methods of your customers.

Of course, we all know about bank transfers or credit and debit card payments, but there are so many more payment options you should have in your store. The more payment methods you have, the more you can expand your customer base and create better customer experiences.

Not convinced? Nearly 50% of customers will cancel an order if they can’t choose their preferred payment option, and many more won’t even start to consider ordering in your store if you don’t offer that option at all.

According to Shopify, retailers can lose a lot of money if they don’t accept as many payment methods as possible.

So here are the most common payment options on the market, and you should have if not all available on your store then as many as possible. Of course, before you add a specific payment method, be sure to check if that one is available in your country/region or if works for your customers.

Credit cards and debit cards

Credit and debit card payment methods are probably the most common way customers can pay when they order online.

Research by BAI Research and Hitachi Consulting actually shows that 41% of consumers are starting to use cash less and less, while 97% of customers surveyed say they are only using credit and debit payments.

So, this means that accepting credit/debit cards is the norm on the market. In other words, this is the minimum retailers can offer in terms of payment methods in their stores.

Credit and debit cards give authenticity and credibility to your store, therefore increasing your sales. This is so common to have it, that if your store doesn’t offer this choice, it will probably push customers away. They may actually feel that your business is not legit.

Now, are there any cons? Not really, even though some will say the fees. But this is only normal, you need to pay fees to the payment processors (or gateways) and the only thing you can do is pay attention when choosing the 3rd party payment gateway.

Bank transfer

You may think this is old-fashioned, but it’s actually not. There are still many customers that prefer using this simple payment method as everybody has a bank account but not all have a credit card.

It’s true that there aren’t many online stores using this method anymore, but in some markets, it’s still the norm to have this choice available.

Another reason why some customers will prefer this payment method is that many are not comfortable with giving you their card details. And being that there are still so many data breaches happening, can you blame them?

This is also probably the main benefit of having a bank transfer as a payment option, the fact that by choosing it your customers don’t have to disclose any financial details to purchase in your store.

Mobile payments

Mobile payments are the new trend as they are experiencing rapid growth. Mobile and smartphone payments, also known as contactless payments, include smartphone payment options like Apple Pay, Google Pay, and Samsung Pay.

Now, in the US, 53% of digital wallet users use digital wallets more frequently than traditional methods. And a Statista survey confirms that the use of apps like Apple Pay and Google Pay is expected to double between 2020 and 2025.

And this was to be expected, right? Most people, the ones that are digitally savvy and always have their smartphone with them, will always be inclined to pay through their mobile.

In other words, this method makes it faster and easier for consumers to pay for their orders, which will definitely increase your sales. When your customers pay like this you can have the option to receive and track their customer data, such as the frequency with which they order your products or how much they spend.

What is a 3rd party payment gateway and why is needed?

When you own a dropshipping store or you want to dropship and sell some products in your store, you need to choose a payment gateway for all transactions. The payment gateways available for you depend on the ecommerce platform you are using. So, if you are on Shopify, you need to choose one that can be integrated with this ecommerce platform.

A payment gateway is essentially a tool or platform that lets your customer buy something from your online store. These payment gateways actually handle all transactions for your online store.

How does it work? Well, after the customer adds a product to his cart, and fills in his shipping address, he then starts to add his payment information. Here is when the payment gateway comes into the picture.

Among many other important things, the payment gateway is there to process the payment information securely, and to deduct the funds from your customer’s account. After that, the same gateway tool deposits the money into your account, so that you can make use of them.

In other words, a payment getaway is a tool that lets you securely process all your customers’ sensitive data, such as payment information, meaning credit or debit information.

Of course, all these services come with a price, and every payment gateway takes a small transaction fee.

Now, before looking into which are the best payment gateways for a dropshipping store, let’s talk a bit about what to look for when choosing the best payment gateway for your business or store.

Keep in mind that depending on the country/region you’re living in and your customers’ preference, some payment gateways are more used than others, and therefore the preferred choice of your customers. So, choose one that they’re familiar with, for example, in the USA, PayPal is the most used ecommerce payment gateway, while in Canada, Payoneer and Stripe are preferred.

And, as we already said, you also need to choose a payment method that can be integrated with the ecommerce platform you’re using and accepts dropshipping.

So, what to look for when choosing a payment method (or a payment gateway) for your store?

Here are some important aspects the 3rd party payment gateway needs to have.

It has to integrate with your ecommerce platform (such as Shopify or WooCommerce) – this is a must and it’s something you have to know from the start. To be sure it can be integrated with your ecommerce store, just check your platform’s app store, for example, the Shopify app store, if you are a Shopify user.

It needs to support dropshipping. Some gateways that don’t accept dropshipping stores, claiming that dropshippers are a high-risk group, due to different reasons. So make sure the payment gateway doesn’t have a rule on their terms of service before deciding to go with that one.

Make sure it works with your country and the currency of your customers. This means that before you make your choice, you need to decide on the country you’re going to sell to and make sure the payment gateway is available in that country and also supports different currencies. It’s essential you choose a payment method that your customers are comfortable with and even recognize. So, be sure to find out what’s the most popular payment gateway in your region. The easiest way to find out this is to check with your ecommerce platform, for example, if you own a Shopify store, here’s where you check the payment methods filtered by countries.

Check that you are fine with the transaction fees. The fees can start from 2% up to 4.9% for some payment gateways. So, do your research and before making your choice, be sure that you have room for that fee in your budget. And if you are planning to grow your store, then you need to be aware that this fee can make a difference to your profit.

Find out if the gateway works in other markets/countries in case you ever want to expand your online store. We already talked a bit about this point above, but we wanted to have it also as a standalone aspect as it’s very important to be proactive. Even if you are not sure where you’re going to expand, why not go for a payment gateway that is available internationally, just in case? This way if you ever want to try other countries and markets, then you are all set. You can also consider the cross border payment process flow when selecting a gateway to ensure smooth transactions across different regions.

Check the payment gateway features and choose a user-friendly one. This is also something that depends from one user to another, but it’s best to choose a gateway that has the features you’re looking for and is easy to use.

Pick a payment gateway with good if not excellent customer service. As always, customer service can make a big difference, so do yourself a favor and go for a gateway that cares about its customers, because this will help you in the long term. You don’t want to waste your precious time being on hold or writing multiple emails to customer service without ever getting any reply.

Best payment gateways for your dropshipping store

If you scrolled to this part and skipped the rest, keep in mind that the following list of the best payment gateways won’t include a lot of details about each of them, so if you want to know what to look for when choosing a payment gateway or what are the most common payment methods, then you need to read the whole article.

Now, below, we will list 11 of the best payment gateways for dropshippers. For each of them, we will go through which countries they are available and also what’s their transaction fee.

We hope this list can be the starting point for you. Once you know which of the next ones you want to find out more about, then you can check all about their features by yourself (through the mighty Google) and see which one suits your business and target market.

PayPal

PayPal is probably the most used payment gateway in online stores. It’s a payment gateway accepted and available in more than 200 countries all over the world. This means that your customers also know it quite well and trust it. Here’s a list of countries where you can use Paypal.

PayPal supports all major credit card operators, such as Visa, Mastercard or American Express.

Now, you can use PayPal by itself or combine it with others, such as Stripe, 2Checkout or Amazon Pay.

In terms of fees, the transaction fee is 2.9% plus a “fixed fee” based on the currency used. But this only applies to USA payments, for payments outside of USA, the transaction fee is 4.4% plus a fixed fee based on the currency.

Shopify Payments

Shopify Payments is built for all Shopify ecommerce store owners out there. So, if you have an online dropshipping store on Shopify, then it makes sense to set up their payment gateway.

It’s extremely easy to set it up, accepts all major credit cards, and once you add it to your store, you don’t have to pay the extra 2% transaction fee if you add other payment gateways to your Shopify store.

Unfortunately, it’s not available in many countries, check the full list here, and you cannot use Shopify Payments for all types of businesses and services.

The transaction fees start from 2.9% plus $0.30 for the Basic Shopify plan and can get as low as 2.4% plus $0.30 for the Advanced Shopify plan.

Stripe

Based in the USA, Stripe is a payment gateway available in over 25 countries. It supports all important credit cards, and it’s quite popular in Canada, Australia and UK. It also offers Shopify and WooCommerce integration.

One of its most important features is that its whole checkout process can be customized. If you choose Stripe, you have also the option to add mobile payments to your store, as it works with Apple, Google and Microsoft Pay.

The transaction fee is 2.9% plus $0.25 on the currency used for international transactions, with an additional 2% fee when a currency conversion is required.

WooPayments

If you use WooCommerce, then WooPayments, the new payment gateway created by WooCommerce in partnership with Stripe, could be the best option for your dropshipping store.

You can use it to process online business transactions right from your dashboard. With WooPayments, you can also accept and process credit cards directly in your store.

Now, the WooPayments plugin is free, which means you don’t have to pay any monthly fees or setup fees. But you do have to pay PayPal and Stripe’s transaction fees. For Domestic credit cards or debit cards, the transaction fee is set at 2.9% + $0.30 for each transaction. And for international credit cards or debit cards, there is a set transaction fee at 2.9% + $0.30 for each transaction.

Apple Pay

Both a contactless payment gateway and a digital wallet, Apple Pay can be the right payment tool for your dropshipping store. If you own a Shopify or WooCommerce store, you have to combine it with Stripe or Shopify Payments, for example.

Apple Pay is a great choice for customers who want to use their mobile devices to make payments. Being designed for mobile usage means that your customers can use it with Face ID or Touch ID when they want to make secure payments.

The payment gateway accepts Visa, Marter Card, American Express and many more.

Now, in terms of transaction feed, it comes with only a flat fee of 2.9% with no additional fixed fees.

Google Pay

Google Pay is an awesome payment gateway tool if your store mostly targets customers in the USA and Europe. Reliable and trusted by customers worldwide, Google Pay can also be perfect for your dropshipping store.

Here are the countries where Google Pay can be used

You can integrate it with a Shopify store through a free plugin without requiring another gateway, like the Apple Pay one needs. Most of the time, Google Pay is combined with Stripe, Adyen, Authorize.net, or Square gateways.

In terms of fees, bank transfers and debit card transactions are free, but when using credit cards and Paypal with Google Pay, you will have to pay a fee of 2.9% of the transaction amount for each credit card or Paypal transaction.

2Checkout

2Checkout is another popular payment gateway available in over 200 countries. It’s very popular in Africa and the Middle East so if you’re planning to sell to customers there, then this payment gateway is great. It also supports all important credit cards, such as Visa, Mastercard, American Express and others.

You can use this gateway tool with Shopify as there is a free plugin and their transaction fee starts at 3.5% + $0.30 per successful sale.

Amazon Pay

Amazon has its own payment gateway mainly for store owners and retailers that have an Amazon store. You can use Amazon Pay if you are in the USA, UK, Germany, Portugal, Spain and more. Here’s the list of countries where Amazon Pay is available.

Even if you don’t have an Amazon store, you can also choose to use their gateway for WooCommerce, Shopify, and BigCommerce stores, as there are free plugins that make possible the integration between these platforms. It’s also optimized for mobile payments, and it’s designed to work with Alexa from Amazon.

Amazon Pay charges a transaction fee of 2.9% + $0.30 for USA payments and a 3.9% + $0.30 fee for cross-international transactions. Find out more about Amazon Pay’s pricing per country on this page.

Adyen

Adyen is quite new in the payment gateway world, being widely used in Europe, but recently it has also become available in the USA. Check here the full list of countries.

It can be integrated with Shopify through a free plugin and can also be combined with Apple Pay or Google Pay for a better reach.

The transaction fee depends on the payment method used and the region you’re in. Check here for the full list of prices for different payment methods. Keep in mind that they charge a processing fee plus a fee per transaction based on the payment method.

Square

Square became a payment gateway recently, after originally being an in-person POS system for mobile devices. At the moment, Square is available in the USA, Canada, Australia, Japan, the United Kingdom, the Republic of Ireland, France and Spain.

It offers free plugins for WooCommerce and Shopify and you can even use it in combination with Apple Pay, Amazon Pay, or Google Pay.

Their standard transaction fee is 2.6% + $0.10, but it can get higher for other payment methods. Check this page for the full list of their fees.

Authorize.net

Currently available for businesses based in the USA, Canada, UK or Australia, authorize.net it’s one of the most trusted online payment gateway providers in those parts of the world.

It has multiple integrations available, including the option to easily integrate it with your WooCommerce (paid plugin) and Shopify (free plugin) stores. Most dropshippers combine it with Apple Pay, Google Pay, and PayPal for greater reach.

Now, regarding the transaction fee, authorize.net also has one of the lowest transaction fees on the market, from 2.90 plus $0.30. But this fee comes also with a membership fee of $25 per month. Find all about their pricing plans here.

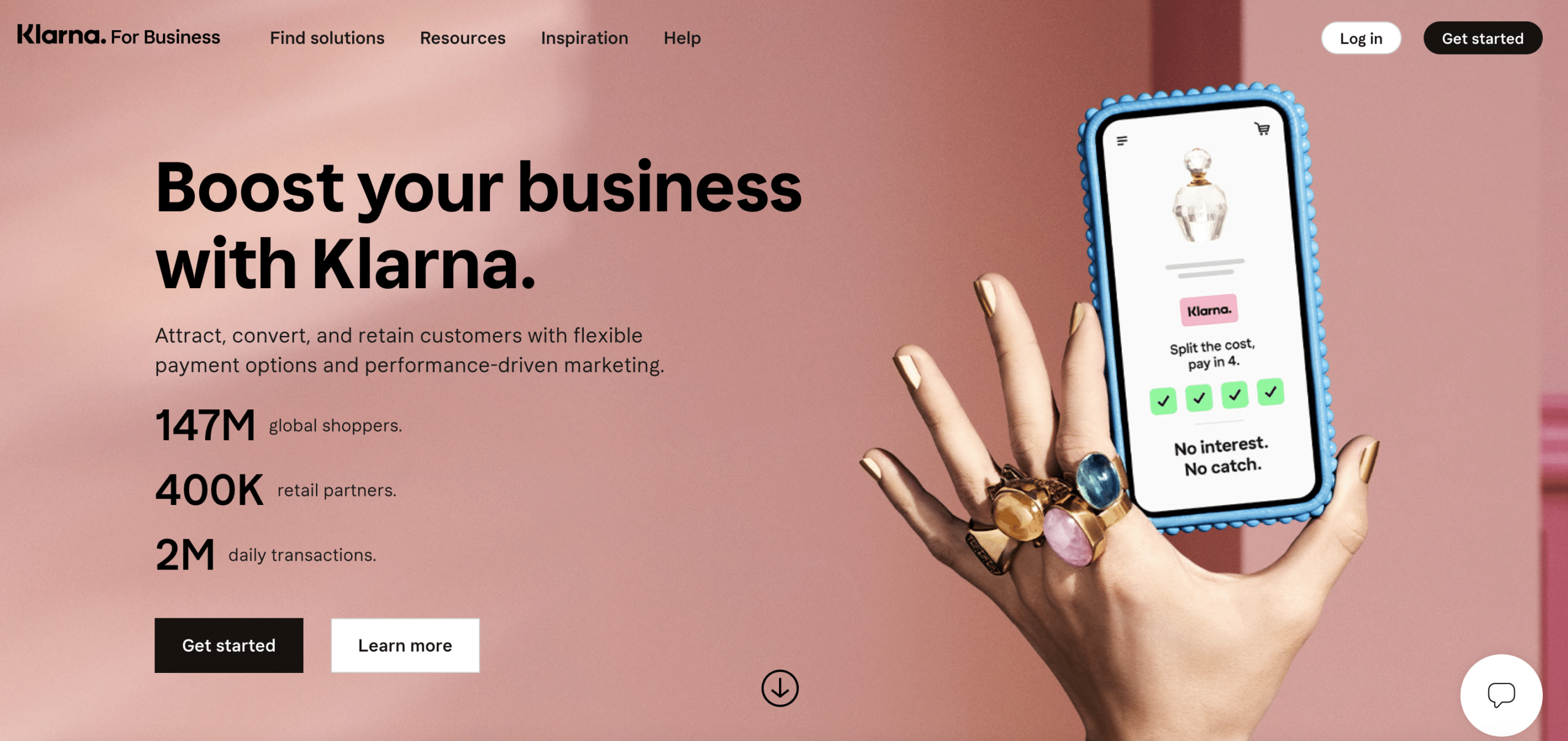

Klarna

Klarna is a bit of a special payment gateway, that’s why we left till the end. It’s a “buy now pay later’ platform that actually refers to interest-free credit providers.

If you choose this platform, you give your customers the option to pay for a product either at a later date or spread its cost through a certain period, rather than pay it all upfront.

Unfortunately, Klarna is only available in some countries or regions, such as Austria, Germany, Sweden, Denmark, the USA, the UK, and more. Here’s the full list.

There is Klarna Pay Later, Klarna Pay Now, and Klarna Slice It, all of these give your customers a variety of options to pay for their order. Customers can pay immediately, by invoice, or via installments using direct debit or credit card.

However, as with most payment gateways the retailer needs to pay a fee per transaction, so keep this in mind before using this alternative online payment option too. Klarna hasn’t made its transaction fees available, you need to contact them for that. However we do know that the fee depends on the payment method used by the consumer and the country of the transaction.

If this payment gateway is not available in your country, don’t worry, there are many more alternatives to Klarna you can choose from. Among the most popular are Affirm, AfterPay or Sezzle. Here’s a great review article to help you decide.

Crypto Payments

This is yet another special payment method to add to your dropshipping store if you really want to have all possible options available. And you should. Even though you may have no experience with cryptocurrencies, it’s actually quite easy to set up this type of payment on your store, especially if you have a Shopify store.

Among some of the most popular crypto payment gateways are Coinbase Commerce, CoinPayments and BitPay. All of these three tools can be integrated with Shopify and WooCommerce, have low transaction fees and are available in many countries.

Yes, the transaction fees can be lower than 1%, and some crypto payment gateways even offer a transaction fee of 0%, but the catch is that you need to pay a fee when you want to withdraw your payments.

We highly recommend adding such a crypto payment option to your store as many experts predict that the value of cryptocurrencies will get higher and this can only open up your business to new customers.

If you want to know more about this innovative payment method, then go check this article.

Most of these payment gateways can work just fine, as they all have their pros and cons. But one important aspect you always need to keep in mind is to go for the one that will make your customers happy.

Which one you should use for your dropshipping store?

Well, this is tough to answer. It depends on so many aspects, from your own personal preference to what your customers actually prefer. For the ones of you who aren’t yet sure what to choose, here are our recommendations.

If you are a Shopify user, try to get approved with Shopify Payments. That would be the best option for you. Unfortunately, only some countries are accepted. In case you don’t have Shopify Payments in your country, Stripe is the best alternative normally. But if you can’t get accepted with Stripe either, you will need to look for alternatives, such as PayPal, Authorize.Net, Apple Pay, and Google Pay.

If you use other e-commerce platforms, like Wix or Ecwid, then Stripe is going to be the best option for you too. Now, Stripe has started to decline new accounts lately, especially if a store looks new or unprofessional and seems made by a beginner. So, always ensure you have a company incorporated, contact details, and policies properly set on your store before you register an account with them or they will just decline you.

If you use WooCommerce, then WooPayments, the new payment gateway created by WooCommerce in partnership with Stripe, would be the best option for you.

Even if you get approved with Shopify Payments, Stripe, or WooPayments, we recommend installing PayPal as an alternative. Many users have funds in PayPal or they even receive their salaries via Paypal, so it’s easier and cheaper for them to just use Paypal to make purchases online. And we can tell you that in most Western countries, PayPal is used by around 15% to 30% of your potential customers.

So, whether it is PayPal and Stripe, Shopify Payments, or WooPayments, all these gateways offer reliability, flexibility, and global reach. Mix and match to create the perfect payment solution for your store and market.

How can you safeguard your payment gateway account?

In dropshipping, it’s essential to keep a low chargeback rate. But what exactly do chargebacks mean, and why should you be concerned? Well, a chargeback occurs when one of your customers disputes a transaction with their bank, seeking a refund for various reasons, such as poor quality or failure to receive products. While refunds are manageable, excessive chargebacks can mean trouble for your payment gateway account.

In recent years, gateways like Stripe, Shopify Payments, or PayPal have become more vigilant, suspending dropshipping accounts more easily with chargeback rates exceeding 1%. What does a 1% chargeback rate mean?

Simply put, a 1% chargeback rate means that 1% of your customers or orders have open chargebacks with their banks, wanting their money back and jeopardizing your account’s stability.

To protect your payment gateway account and keep chargebacks at bay, start by putting in place a solid returns process and a crystal-clear return policy. So make sure your customers can easily navigate the returns process and understand your policy. If returning an item becomes impossible or confusing, they will likely resort to chargebacks out of frustration.

Also, prioritize responsive and proactive customer service. Answer their questions about shipping, tracking numbers, and return requests promptly and professionally. Neglecting these aspects could lead to customer dissatisfaction and increase chargebacks.

Conclusion

To sum it up, choosing the right payment method for your dropshipping store can make or break your store. While there isn’t a one-size-fits-all solution, it’s important to meet your customers’ preferences.

Now, as it’s safe to say that PayPal is the most used gateway, you can definitely start with it, as most customers trust it and use it. But it’s recommended to always mix it up and use more than one payment gateway.

However, it’s recommended to offer a combination of payment methods, including credit cards, such as Stripe or similar (like Shopify Payments), plus other international gateways, and mobile payment options like Google Pay and Apple Pay. On top of this, if you have business customers, you also need to offer them a bank transfer payment option.

Below is an example of the best combination you can possibly make if you want to offer all options for all kinds of customers:

Stripe or similar + Paypal + Google Pay + Apple Pay + Klarna + Crypto (+ Bank Transfer for business customers)

Remember, make sure you select a payment gateway that ticks all the boxes for compatibility, fees, and customer service. With the right payment options in place, you’ll be on your way to fulfilling orders and growing your business.